Capital Project Activity Is Expected to Remain Stable Across North America

North America Capital Projects Update

North America, and IPA’s work in the region, reflects a changed capital project landscape that few could have predicted 5 or 10 years ago. Capital expenditure in oil and gas exploration and production and refining projects has declined considerably since 2014 when oil prices declined sharply—preceded by declines in mining and mineral prices. On average, companies reduced their capital expenditure by 30 percent from 2014 to 2015. Similar cuts have been made in 2016. As a result of these cuts to capital expenditure, capital project activity has been curtailed across Canada, the United States, and Mexico. The surprise election of Donald Trump to become the next U.S. president has heightened the uncertainty for owner companies investing or planning to invest in capital projects in the United States, but, for now, oil prices and other commodity prices have mostly remained stable. We are now catching a glimpse of the light at the end of the tunnel as it is IPA’s perspective that capital expenditure cuts in the United States have bottomed out.

Activity Ranging From Small Regulatory Projects to Megaprojects

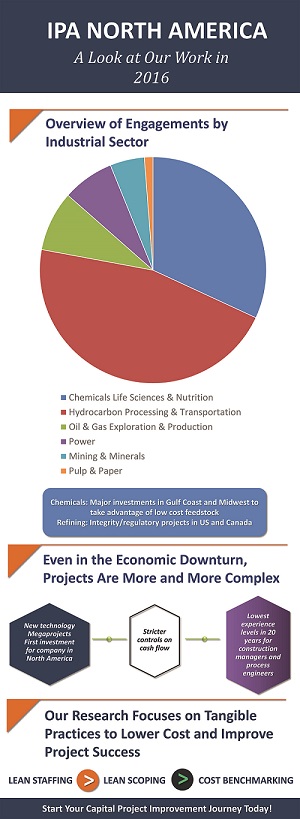

In the fourth quarter of 2016, we are starting to see some major new E&P projects in the early development phases. With many E&P and refining companies already operating significant capital assets in North America, IPA remains busy benchmarking a steady stream of small integrity- and regulatory-driven projects that must proceed to keep assets running, even in the economic downturn. Further, in contrast to the oil sector, the chemicals sector in North America is quite robust, driven by a return of capital to the United States to take advantage of low-cost feedstock. IPA has been privileged to evaluate a number of groundbreaking megaprojects in the United States, many representing firsts for the companies involved. In particular, IPA recently evaluated a client’s first project developed in North America and another client’s first megaproject. Clients are reaching out to IPA to evaluate project risk and help ensure projects are optimally defined before a final investment decision is made. We are also providing regional construction labor wage rate and productivity forecasts for clients and benchmarking team staffing levels, team interactions, and dynamics to ensure projects are organized for success. We expect this work to continue in 2017.

Challenges for Pharmaceutical, Power, and Infrastructure Capital Projects

Challenges for Pharmaceutical, Power, and Infrastructure Capital Projects

Our work in the pharmaceutical and power sectors has also been growing, both with long-term customers and companies new to benchmarking. As the power sector faces some de-regulation, it is critical for power companies to ensure the competitiveness of their capital projects. Further, increased investments in natural gas and renewables are driving capital investment. And recent mergers and acquisitions in the pharmaceutical and power sectors are resulting in the need to evaluate new assets and compare, merge, and streamline work processes from the merging companies.

IPA is also serving the infrastructure capital project market, as these projects face similar challenges as projects in the process industries and benefit from the same Best Practices.

Regardless of industrial sector, the current market climate presents key common challenges. Businesses across sectors have an unrelenting focus on justifying and minimizing their capital costs. Consequently, companies are seeking help from IPA in innovative ways. Today, companies are turning to us to conduct early cost benchmarks of projects still in the “idea” phase and to weed out design options that are not economical. Companies are also turning to us to perform organizational reviews to ensure core competencies for delivering projects are maintained and to determine which competencies can be outsourced. IPA is also being asked to overhaul existing work processes to ensure they are fit-for-purpose for the lower capital spend companies anticipate in the years to come.

Opportunity to Improve Project Performance and Lower Capital Costs

While capital project markets are down from peak years when commodity prices were higher, North America continues to represent an attractive location for capital investment, and we anticipate stable levels of capital investment in the region in the near future. In October, I delivered a keynote at the Engineering News Record (ENR) 2016 Global Construction Summit, where I had the opportunity to speak with and listen to executives at the world’s leading engineering, procurement, and construction (EPC) firms. The perspectives shared during this industry gathering align closely with the insights from the owner companies with whom we work; they agree that the United States, in particular, is likely to remain one of the few robust areas for capital investment across the globe in the years to come. From unconventional shale development and “re-shoring” of consumer product and pharmaceutical spend to meeting the latest environmental requirements for refineries and the power sector’s move away from coal to low-cost natural gas, capital investment will continue in North America, along with the continuing need to improve project management processes and demonstrate competitive cost and schedule performance.

The economic climate remains challenging, but these challenges bring opportunity. Now is the time to hire the best talent, for business and engineering to align early on the best opportunities to develop, and for owners and contractors to collaborate closely on approaches such as standardization and lean scoping. It is also the perfect time for leading companies to demonstrate the significant value strong work processes and Best Practices can bring to their balance sheets. To make the best of what looks to be a favorable landscape for delivering capital projects across the region, owner companies need to be prepared to deliver improved project performance and lower capital costs.