Keeping Up With the Changing Times in Capital Projects

Although capital investment has rebounded to pre-COVID-19 levels, project results and delivery practices are still facing major challenges. The current capital projects climate is under stress from the complexities of the sustainability transition, including unclear direction from governments, uncertain long-term business prospects, unfamiliar technology, and new business cases and venture formation. In addition, spillover effects from the sustainability transition are affecting most major industrial sectors and project supply chain players—even those planning to opt out of the changes.

Below I discuss the changing times in capital projects and some of the major hurdles today’s capital projects market is facing.

Commercial

Commercial agreements are difficult to secure for many projects because the economics are often marginal, particularly without clear sustainability pricing, and the markets are undeveloped and often uncertain. When projects involve a bidding process or government subsidies, the business case and commercial agreements often must be committed early in the project development cycle when very little is known about the market and potential pricing of products.

Partnerships and Relationships

New relationships and partnerships between owners, contractors, licensors, suppliers, governments, and regulators need to be developed—something many companies have not had to do in the past. Sometimes these new partnerships are even within our own companies. Projects done using joint ventures (JVs) must align the partners on objectives, which is difficult because of different risk tolerances, corporate visions, and ways of working. For example, if one JV partner does not have a net zero goal and the other does, the two organizations are likely to have very different priorities for the shared venture.

Another main challenge is developing partnerships and relationships with inexperienced newcomers. This includes new technology licensors who don’t understand how capital projects are developed; new contractor divisions to provide services in emerging sectors that are unprepared; and new owners with unstable finances that create uncertainty for their partners in engineering, procurement, and construction (EPC).

All of these issues around partnerships make for uncertainty and churn in the capital projects environment.

Stakeholders

The industry has done quite well when the stakeholders were known quantities with stable regulatory regimes and in well-known regions. However, the industry has not done consistently well when we aren’t as familiar with these stakeholders—and sometimes fails to even identify the stakeholders at all. With new energy projects, stakeholders will be less familiar or unknown, and those that are known or are discovered will have minimal experience with capital projects. In some cases, the regulatory framework will not exist and will need to be developed. Even if the technology is straightforward, stakeholder management mistakes can lead to project failure.

Faster Pace

Companies tend to always want to do capital projects faster. We have seen things go terribly wrong when owners try to go faster than they know how to or faster than is feasible while sufficiently mitigating risk. Where the industry has often been able to go incredibly fast is with projects with very high returns. High returns have a way of wiping out our institutional memory of projects that have gone sideways. We need to carefully consider how we can become faster without sacrificing value in a low returns environment. Considering the multitude of challenges facing the industry, moving fast while delivering successful low returns projects is a near impossible task.

Technology

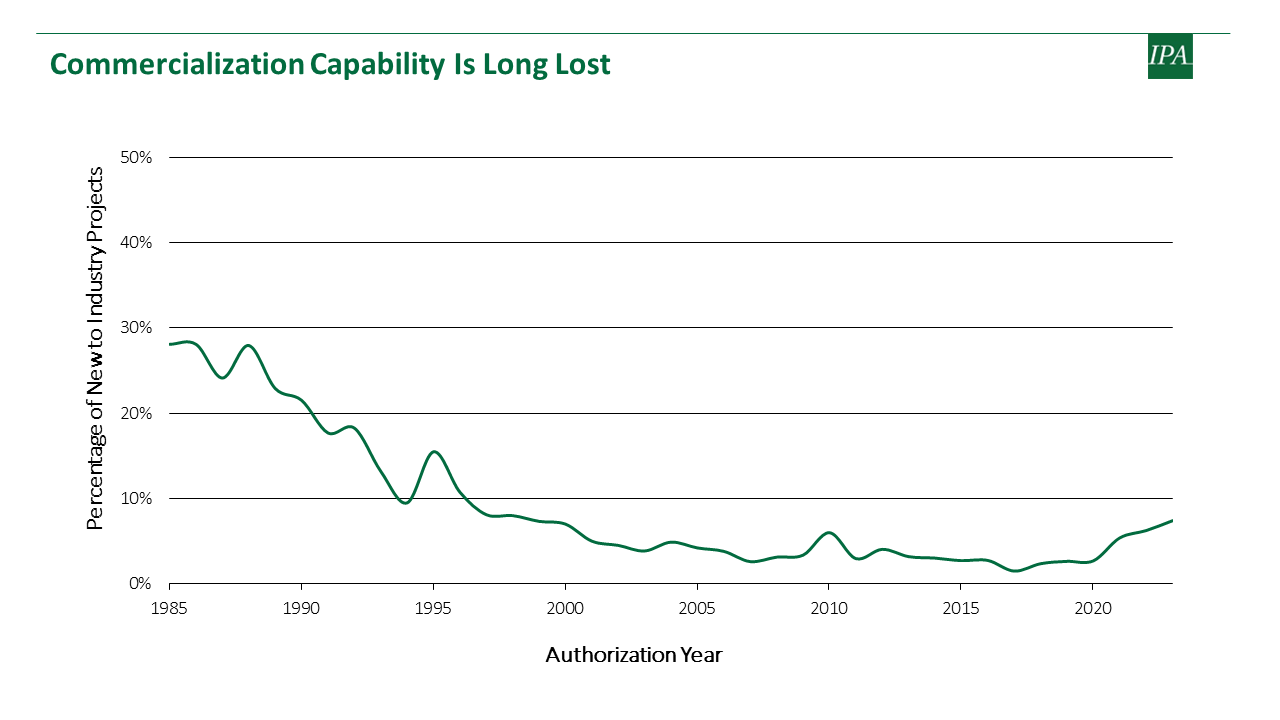

Industry is out of practice with new technology: about 30 years ago, we saw the industry regularly innovating with a significant percentage of projects developing new technology. That declined in the late 1990s and early 2000s, but is now once again on the rise and becoming increasingly important.

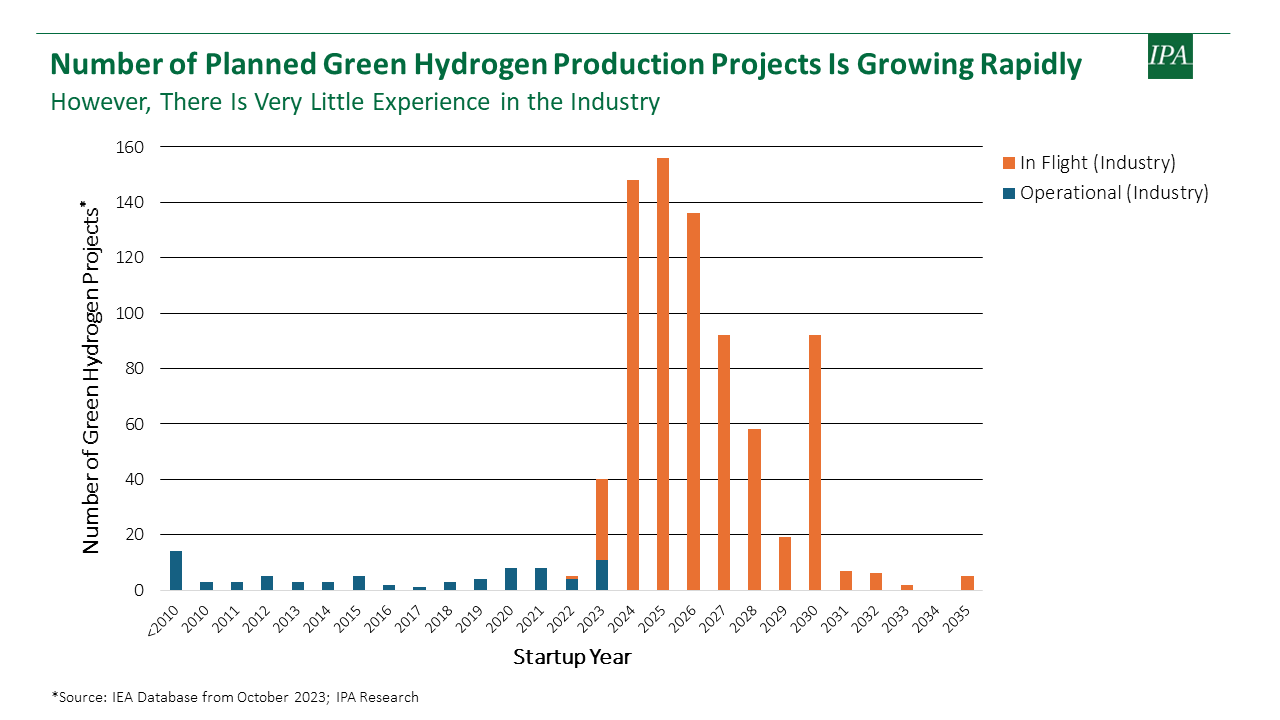

For example, if we look at the number of green hydrogen production projects in the pipeline, we can see a spike in the years following the pandemic. How these projects will fare is unknown, given the industry’s general inexperience with commercialization.

Supply Chain

The capital project supply chain is stressed at every step, starting with the owner’s ability to staff teams to put together a good scope for the project requirements. Engineering contractors too are struggling with finding experienced and skilled personnel. Once the design is complete, that triggers firms from around the world to provide and often to custom fabricate those materials and deliver them to the place of assembly. Although equipment and material supply chains are stabilizing post-COVID-19, geopolitical and new shipping problems continue to arise. Finally, construction firms that either assemble projects on-site or deliver assembled modules to site markets are still highly stressed, especially in places like the Middle East and United States.

There are also challenges with developing new and rapidly expanding technologies that can meet large-scale deployments typical of energy projects. These challenges often mean limited markets, which exasperate escalation, and the need to develop new, large-scale supplier relationships. On the bright side, for some of the technologies, there is also an opportunity to lower costs through standardization.

Governance

Many of the new challenges also create problems in the project governance process. Work processes may not have the needed elements to address some of the new challenges and, in many cases, gatekeepers are unprepared to correctly assess the project’s readiness to pass through gates. A common question is whether the gates are even needed. Our research clearly shows that when a gated process is followed, the return on investment is far better (27 percent) than when the process is ignored. Gates are still needed—but that is not to say that existing work processes don’t need some clarifications or modifications to better address the new challenges. This is, in fact, a common question posed to IPA and a common work front for our Capital Solutions group.

Addressing governance gaps will clearly be needed. Although our clients say that their process is clear and well understood by project teams (88 percent) and 70 percent of project teams say that the process is followed on every project, we find that only 18 percent of projects have Best Practical definition at full funding. This is likely because we allow deviations to the work process in response to project circumstances; in other words, when it comes to governance, exceptions became the norm.

Staffing

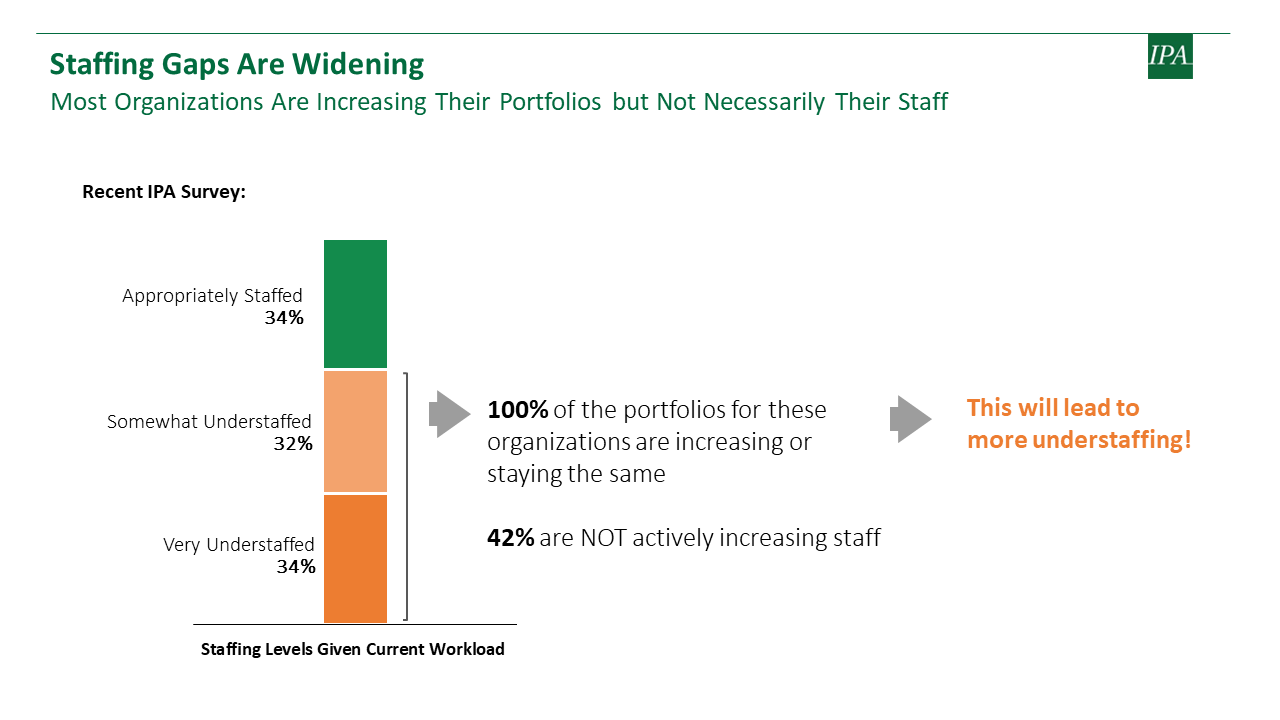

The availability of personnel, particularly those with deployable experience, is compounding the industry’s inability to cope with change. The workforce is aging and fewer people are entering the workforce to take their place. The result is a shrinking talent pool, which is exasperated by increasing competition from other industries. Ever changing portfolios, both in size and project type, make the situation even more dynamic and difficult to navigate.

We are increasingly hearing our clients say things such as, “We were only able to deliver half of our portfolio because we didn’t have enough people,” “Projects are taking longer because we are short on staff,” or “The skills are not there.” To make matters worse, most organizations plan to maintain or increase their portfolios—without a corresponding increase in staff.

We Can Meet the Challenge

The challenges industry is facing are daunting. Combined with the uncertainties associated with the long-term viability of the business prospects many of the sustainability efforts face, we see corresponding patterns in long-term investment:

- Companies that had coherent strategies are being forced to rethink

- Company executives are struggling to plot a long-term strategy

- Oil companies have limited their exploration budgets and consequently have few projects to work on

- Chemical and minerals companies don’t know whether they need to invest in the chemicals and metals to support the energy transition or not—and these are big, lumpy, and irreversible decisions

- Vendors and suppliers don’t know whether to invest in the new capacity that is apparently needed

However, the change will bring many opportunities: new ventures, a different perception of the industry that attracts new talent, personnel growth, leadership development, and a lot of learnings. We can meet this challenge by:

- Focusing on technology strategy and how it aligns with our organization’s business strategy

- Developing, maintaining, and leveraging existing project supply chain relationships to identify and shape the right opportunities

- Maintaining project discipline and strengthening the governance process for portfolio optimization

- Strengthening our staff: retaining current competencies and developing new ones

Complete the form below if you would like to discuss how IPA can help your company can keep up with the changing times in capital projects.