Making Sense of E&P Industry Owner’s Capital Project Costs

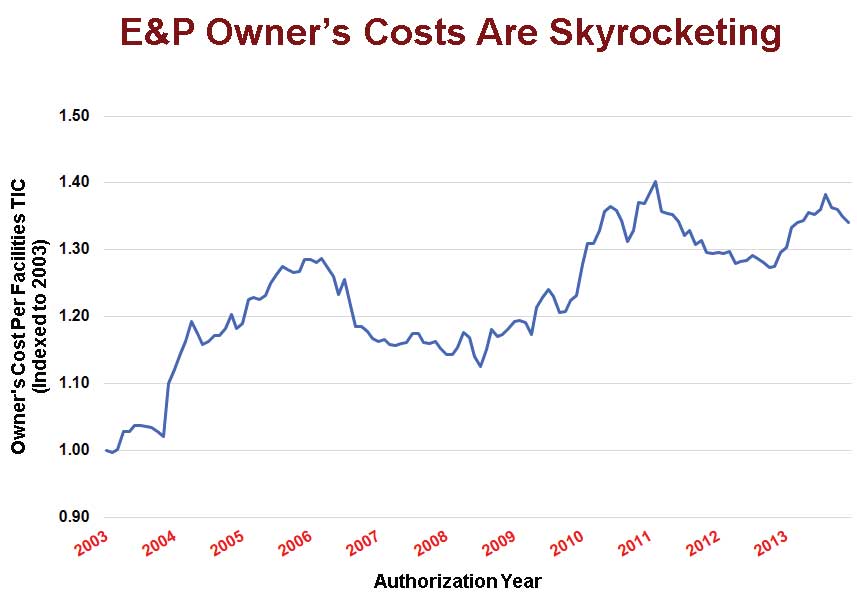

Exploration and production (E&P) owner companies have seen the amount of owner’s costs spent on the development and execution of capital projects skyrocket for over a decade. When oil prices were around $100 per barrel, owner companies had little reason to concern themselves with increasing owner’s costs.

But with today’s lower oil prices, many companies are seeing their capital expenditure (CAPEX) budgets shrink. Owner’s costs, which have increased by 40 percent in the last decade, are now a concern.

Are Asset Development Costs Being Spent Effectively?

The fundamental question owner companies are raising is: “What’s driving increasing owner’s costs and what can be/should be done about it?”

There is a general, high-level understanding throughout the industry that higher owner’s costs must be associated with larger project teams. However, no one has asked whether the larger owner teams are justified in each and every case and whether the makeup of the large teams are appropriate. In other words, is the owner’s cost being spent effectively?

The increased size of many owner company project teams, however, can in large part be linked to a more complex capital projects environment and demographic challenges. New technologies, harder to reach reserves, and new regulatory and permitting arrangements have forced project organizations to bring project specialists on board to advance projects through development. Meanwhile, project teams are hiring additional staff to replace more experienced engineers and other in-demand project professionals—cost estimators, for instance—who are leaving the workforce.

IPA data have shown that asset development engineering productivity has fallen off, in particular. So even if larger project teams have caused owner’s costs to increase, companies cannot easily overlook the drivers of project team size.

Put another way, there are no straightforward answers when it comes down to figuring out how to rein in asset development owner’s costs. Staff reductions, for instance, will not change the fact that today’s complex projects environment requires sufficient staffing in key functions to deliver capital projects effectively. And looking forward, projects may become even more complex.

Instead, the challenge confronting owner companies is the development of smart staffing strategies that will drive owner’s cost down without risking poor project performance and outcomes. IPA research has demonstrated that owner-led teams actually provide the foundation for project success.

Crucial to owner-led project team success is staffing with owners in key functions, including engineering, construction management, and project services.

IPA recently completed a multi-client study that takes a closer look at E&P industry project owner’s costs. The study examines several elements responsible for driving owner’s costs higher, reviews how staffing decisions have helped and hurt project outcomes at key stages of development, and proposes ways that companies can better manage owner’s costs.

IPA’s Owner Cost Study is still available to companies interested in gaining unmatched insight into what has been driving the rise in owner’s costs and learning about strategies to leverage owner’s cost savings.

The study also provides an assessment of each participating company’s owner’s costs practices and shortfalls.