Projects and the Pandemic: Disruption and Adaptation

As the COVID-19 pandemic first started to take hold in early 2020, IPA started collecting data to record its effect on capital projects and the companies that do them. IPA sent out its first survey in March 2020 and has since issued seven more, with the latest in September 2021. These surveys track four areas of response to the pandemic: effects on internal project system operations, supply chain disruptions, portfolio implications, and mitigation strategies. More than 60 companies from all industrial sectors including E&P, chemicals, power, and pharma responded to the most recent survey, which collected data from hundreds of project professionals.

Internal Operations

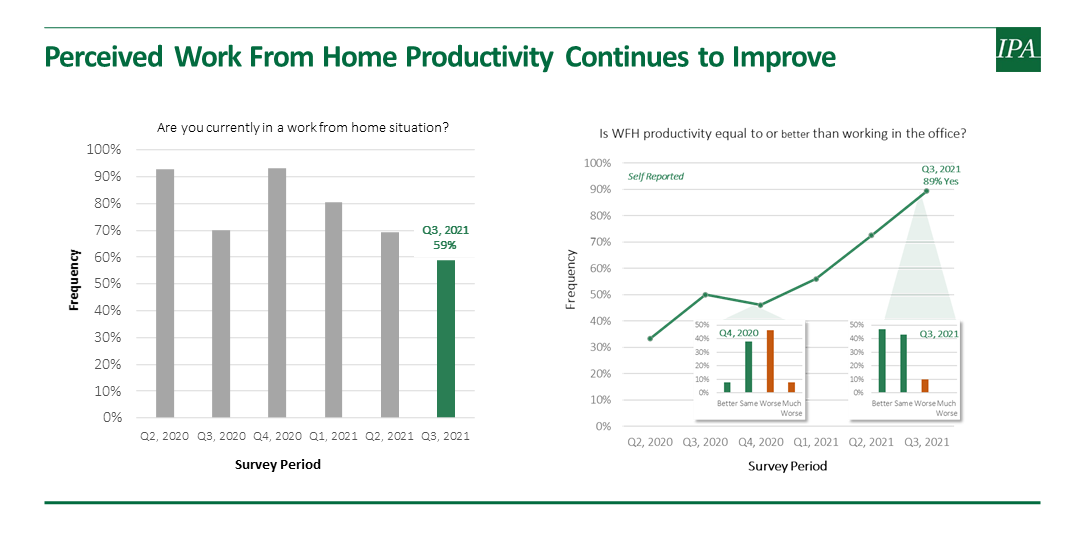

One immediate change that occurred early in the pandemic is the shift to working from home: as offices shut down, those who could work from home largely did. Although the percentage of people working from home has decreased steadily since Q4 2020 when it peaked at over 90 percent, 59 percent of survey respondents were still working from home in Q3 2021. As the pandemic has progressed and adjustments have been made to support employees who are working from home, the percentage of people who felt they were as productive or more productive at home as in the office rose from a low of 32 percent in Q2 2020 to the current high of 89 percent. Possible reasons for such a shift include a recency bias (it’s hard to remember what it was like working in the office so we assume working from home is better) and lower work demands (i.e., less work overall).

However, although the perception of productivity at home has improved, those working both from home (WFH) and those working from the office (WFO) report spending more time in meetings than they did pre-COVID, with those WFH spending an average of 9 hours more per week in meetings versus 3.5 hours more per week for those WFO. It seems casual interactions in the office have been replaced by formal meetings in pandemic times—without causal conversations by the water cooler and in the hallways more structured interactions are needed.

Overall, the benefits of working from home—including more flexibility, no commute, and less travel—are counterbalanced by more meetings, a harder time striking a home/work balance, and longer hours.

Supply Chain

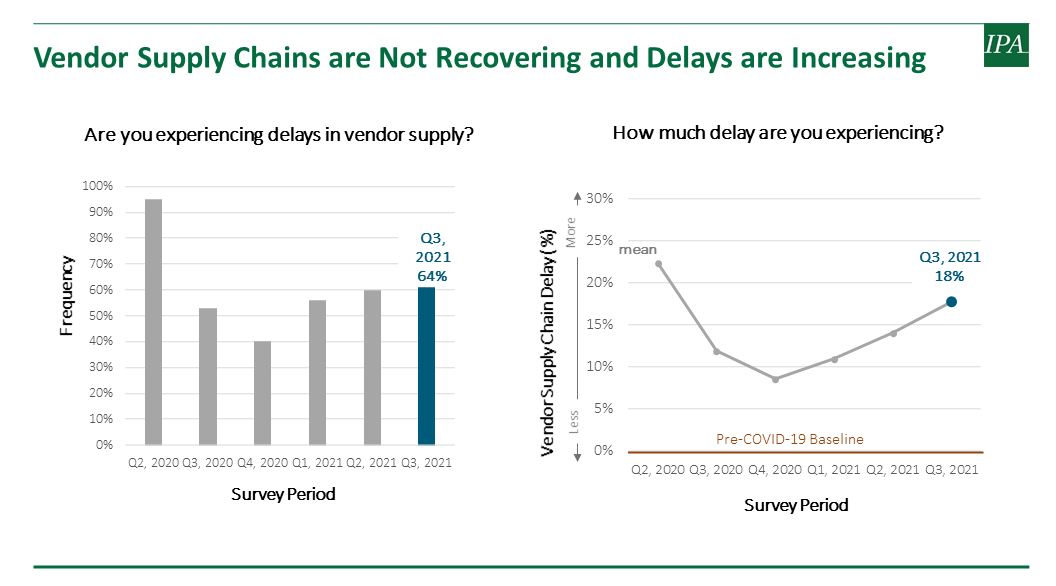

Damage to project supply chains was one of the first manifestations of the pandemic. After the initial very high rate of respondents who reported experiencing vendor supply delays (more than 90 percent in our first survey) dropped down to a low of about 40 percent in Q4 2020, those delays began to steadily increase again and were reported as 64 percent in the latest survey. The percentage of delay followed the same pattern of starting high (at over 20 percent), decreasing to below 10 percent, and then steadily increasing back up to 18 percent, close to beginning of pandemic rates.

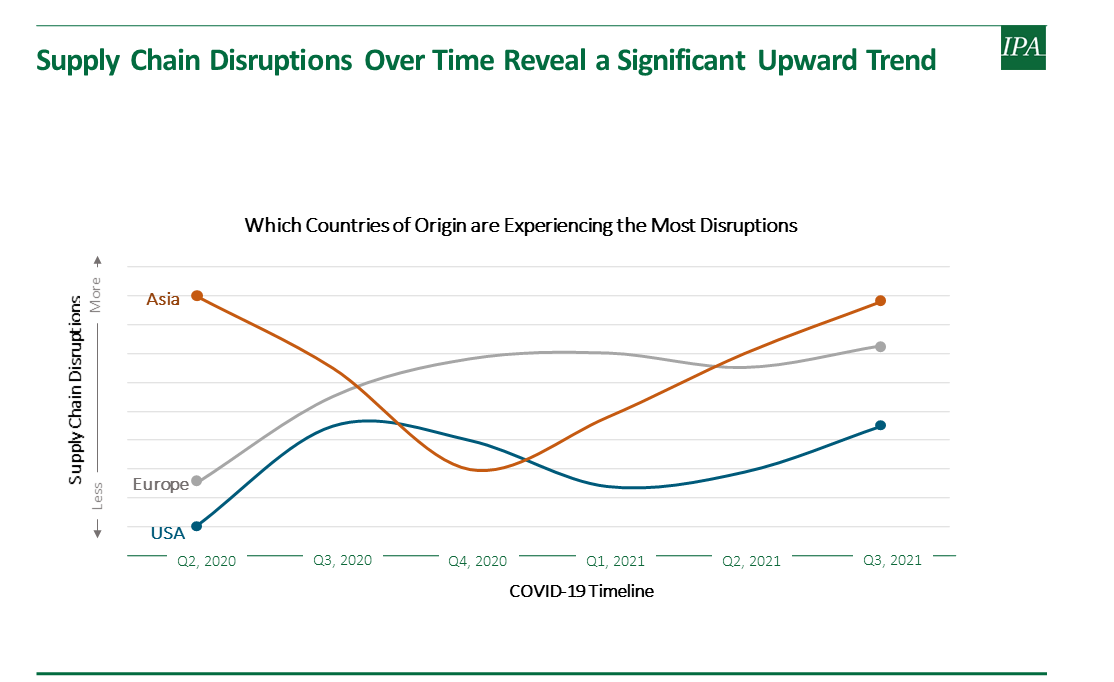

We found these supply chain delays span all sectors, with equipment delays the most frequently mentioned. In addition, these supply chain disruptions reveal a significant upward trend in all regions, with Asia and Europe the most affected. As one respondent reported, “[We are] experiencing delays from everywhere (US, Canada, Europe, Asia). It appears that no country is immune.” Another said, “Overseas shipping is horribly delayed. As a result, we have stopped sourcing from outside of the US.”

One contributor to the supply chain issues is logistics: half of owner companies cited logistics as the driver behind the supply chain issues. Of the respondents, 32 percent of owners reported difficulty getting freight on board for shipments out of China, 30 percent reported limited resources at ports (including labor to load the ships), and 28 percent reported limited vessel availability. The responses we received indicate the situation in China was much worse than was reported in the news, with respondents indicating they encountered widespread congestion and backups and major shutdowns of ports and airports due to quarantines of thousands of Chinese workers.

The majority of respondents have concerns about the effect of COVID-19 on the subcontractors or suppliers they have relied on in the past. Layoffs, consolidations, and bankruptcies are among the issues these subcontractors and suppliers are facing. However, only 18 percent of owners say that they have verified the financial and operational standing of the vendors they rely on in the last 90 days.

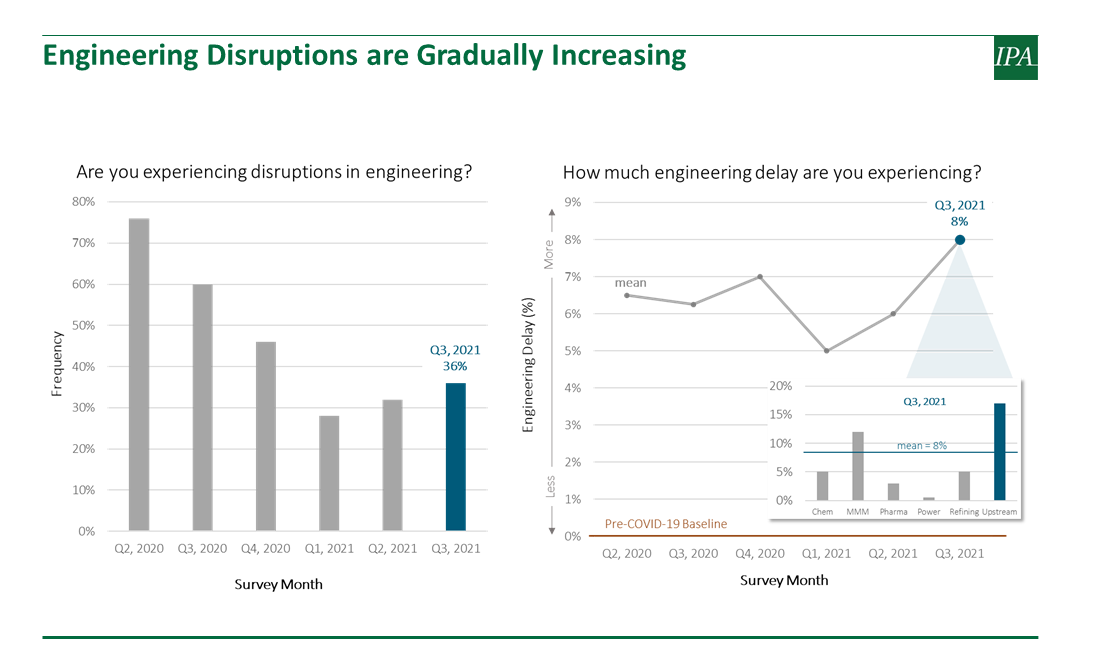

Engineering disruptions and delays are also on the rise again after coming down from their initial highs. In fact, not only are engineering disruptions increasingly frequent, but the percent of engineering delay has also risen to 8 percent, higher than just under 7 percent at the start of the pandemic and with no signs of abating. Although all sectors are showing at least some delay, respondents from the upstream sector cited over 15 percent delay in engineering, more than any other group, with MMM the closest at about 12 percent.

Engineering delays are exacerbated by the fact that less than half of all Indian engineering value centers (EVCs) are working at full capacity and almost 20 percent are working at less than a quarter of capacity. This is concerning because many companies rely on these EVCs for project engineering (including EPC contractor work), with about half of the sample relying on them for up to 20 percent of their projects’ engineering and about a quarter relying on them for 50 percent or more of their engineering.

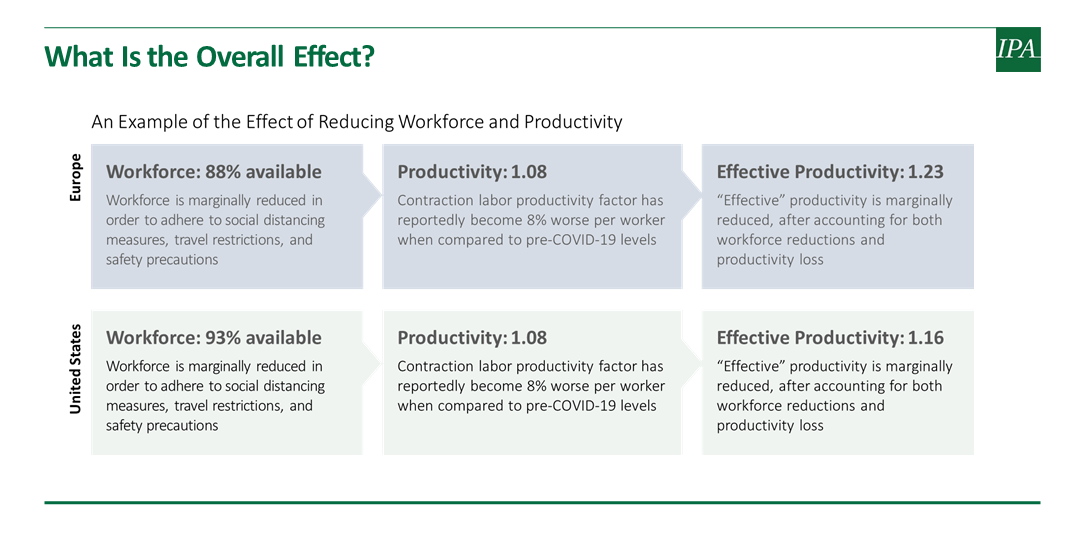

Construction labor productivity provides the lone bright spot in the supply chain. Productivity has improved after its dip early in the pandemic and appears to have leveled off in Europe and in the United States to a rate of about 8 percent worse than it was pre-COVID-19. Availability has also improved since the initial hit, with rates now around 90 percent for the United States and Europe. As shown below, the slightly reduced workforce availability and somewhat worse productivity combined results in an effective productivity of 1.23 for Europe and 1.16 for the United States when compared to pre-COVID levels.

For the U.S. Gulf Coast (USGC) in particular, indirect costs have risen by 10 percent to cover various increases associated with logistics such as busses, food tents, and lodging. However, direct costs have not changed significantly, and skilled labor is readily available. General contractors working on the USGC report that welders and pipe-fitters are calling every day looking for work. In addition, productivity might be even better than pre-COVID because of a reduction in meetings at the site. Overall, although there is a lot of concern regarding inflation, owners can hold the line on wages because the labor is available and productivity is good.

Outside the United States and Europe, the findings are much less encouraging. The combined effect of workforce availability and productivity in Asia and South America results in much less effective productivity in these regions. Worse labor productivity (33 percent worse in Asia and 27 percent worse in South America) combined with worse construction labor availability (63 percent in Asia and 78 percent in South America) means effective productivities of 2.11 and 1.63 compared to pre-COVID levels in Asia and South America, respectively.

Finally, although the current situation has not returned to pre-pandemic levels, companies are seeing the supply chain open back up as activity has largely resumed. As one survey taker noted, “Most areas are open although deliveries continue to be delayed.”

Portfolio Implications

After putting projects on hold at the start of the pandemic, about a third of companies in our survey say they are planning a significant increase in the number of projects entering execution, led by the pharma and chemicals sectors. Although a sizeable number of companies are planning to ramp back up in the new year, this percentage is down from 6 months ago when almost half of the companies surveyed were planning to increase their activity. Another finding is that about a third are making strategic shifts in the types of projects their companies are planning, with new energy projects being one major new area of activity. Refining and upstream are the sectors leading this shift to a focus on renewables, sustainability, and low carbon.

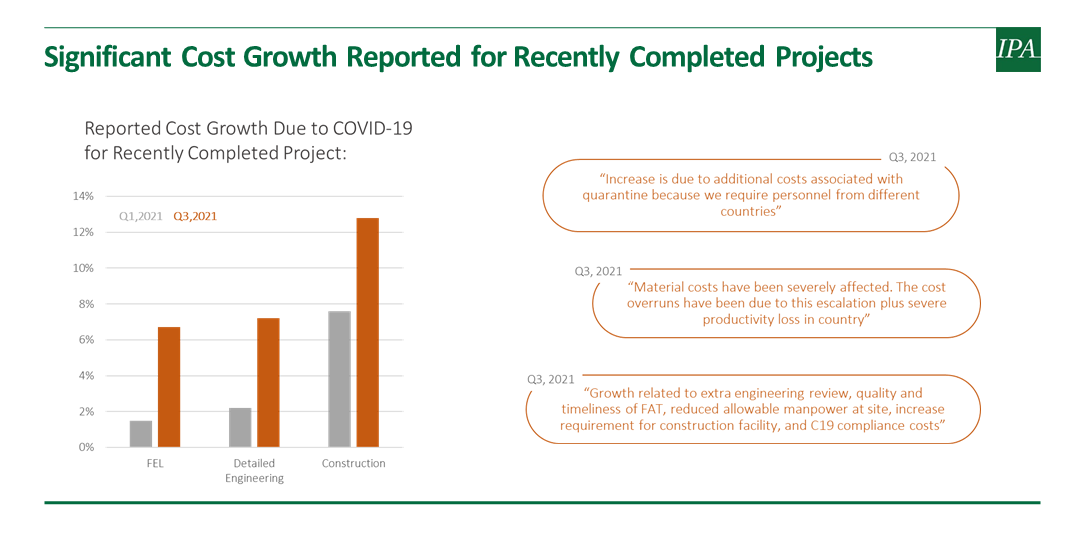

Recently completed projects are showing increased cost growth as COVID restrictions, increased material costs, and other pandemic-related costs increase overall project costs. Cost growth has increased in all project phases: project definition, detailed engineering, and construction.

Mitigation Strategies

As owners struggle to deal with the ongoing pandemic, their strategy can be best described as hope for the best, prepare for the worst. Owner strategies to mitigate supply chain disruptions include looking for alternate vendors, placing orders earlier than usual, requiring weekly updates from key vendors, and offering incentives for acceleration measures. Even as owners implement these measures, they should be prepared for the worst as procurement slip increases the likelihood of field growth and unpredictable projects.

Conclusions and Path Forward

Overall, we found that:

- Even as owner WFH productivity appears to be improving, anecdotal signs suggest that it is not as good as reported. Current perceptions of at home productivity may be colored by a recency bias—that is, the situation may appear better compared with the early days of the pandemic rather than compared with pre-pandemic times.

- The supply chain has not fully recovered, and significant delays are still common across all areas.

- Engineering delays are now the norm; these delays are growing and EVCs are not functioning at high levels.

- Construction labor in the United States and Europe appears to be stable, with skilled labor generally available and with reasonable productivity. However, the labor workforce outside of U.S. and European markets is still struggling.

- Finally, the pandemic has accelerated the shift toward renewables, low carbon, and digitalization.

As we look to the future, the longevity of supply chain disruptions is the big unknown. Supply chains have not rebounded as hoped and the situation in Asia is more dire than it first appeared. Shortening and simplifying project supply chains should be a first order of business in 2022.

IPA will continue to survey our clients to gather real time feedback, and publishing relevant insights on our dedicated COVID-19 resource page.

Jason Walker is the Principal Deputy Director of Research at Independent Project Analysis (IPA). Over his career Jason has led dozens of research studies, mostly in petroleum E&P. Before joining IPA, Jason worked for the Environmental Protection Agency and performed research for the National Aeronautics and Space Administration (NASA).