Supply Chain and Capital Efficiency Gains

In the last decade the oil and gas industry has been forced to confront enormous headwinds brought about by global commodity pricing crises, strong societal forces in favor of decarbonization, and now, of course, the COVID-19 pandemic’s effects on global markets. While ‘greening’ seems to be the obvious (and most popular) answer, in the short or medium term, oil and gas owner companies cannot walk away from traditional revenue-generating assets. A critical challenge these companies therefore face is an old one – how can they produce their traditional product more cost efficiently and move to lower breakevens? This is an urgent issue that requires innovative solutions lest companies resign themselves to their own demise.

The typical playbook of how oil companies would react to past crises included downsizing and constraining capital outflows. Budget tightening invariably involved squeezing gains out of the project supply chain, many times with no regard for the survival of the vendors’ market. This strategy is not only short-sighted because of permanent destruction of suppliers’ skill and capabilities, but also short-lived: time and time again, once prices recovered, vendor discounts would evaporate.

Following the 2014 oil price downturn, and recognizing the limited space for squeezing costs down further without a sustainable strategic vision, key industry players actively started searching for lasting capital efficiency breakthroughs—new ideas that could sustainably reduce project costs and/or durations. It is in this context that these corporations have been exploring opportunities to reduce third-party spend [1], where 70 to 80 percent of the facilities capital project investment goes. The additional blast of collapsing prices under the pandemic and the now ubiquitous question of economic viability of assets has made exploring these opportunities even more attractive.

An Independent Project Analysis (IPA) study conducted in 2018 with the participation of four major oil and gas companies focused on practices that could provide significant productivity and capital efficiency improvements that are symbiotic for suppliers and operators. The study assessed deepwater facilities competitiveness of two primary scope elements – floating productions units (FPUs) and subsea systems – and found that most opportunities are borne out of the long-known benefits of standardization, repeat supply chain, and simplification of design. This was not surprising: for several years IPA has been studying these practices and measuring their significant contribution to capital gains. What was revealing is how much the combined use of these practices moves the needle in terms of achieving sustainable savings. In addition, the study shed light on how limited industry operators’ approach has been to the systematic implementation of the practices, and the study further helped identify the corporate-wide enablers that are paramount to make the gains permanent rather than fleeting.

Facilities Standardization—both in FPUs and with subsea assets—offers capital cost savings of about 15 percent compared to a customized design. However, the combined application of a standardized solution along with repeat use of the supply chain offers very significant additional gains. Average savings on the order of 25 to 30 percent can be achieved when design standardization is conceived and executed with the same supply chain approach over the life of a program in which the owner team and suppliers (engineering firm, subsea vendors, substructure vendor/yard, topsides fabricator, integrator) remain unchanged. An earlier IPA study revealed that even using a repeat supply chain for non‑standard facility concepts can provide large cost gains.[2]

Repeated use of design is not a new idea. It has been applied in the industry for a long time; however, with the exception of a couple of operators, it has not been done in a systematic manner in the offshore industry and, more specifically, in deepwater where capital investment becomes more intensive. While there are examples of standardization for programs of projects, no wide-ranging industry approach has been undertaken at the overall portfolio level until recently as showcased by the operators participating in the study. If the extended E&P industry aims at institutionalizing standardization, both technical and of the supply chain, the opportunity and challenge lies in extending the approach to global portfolios.

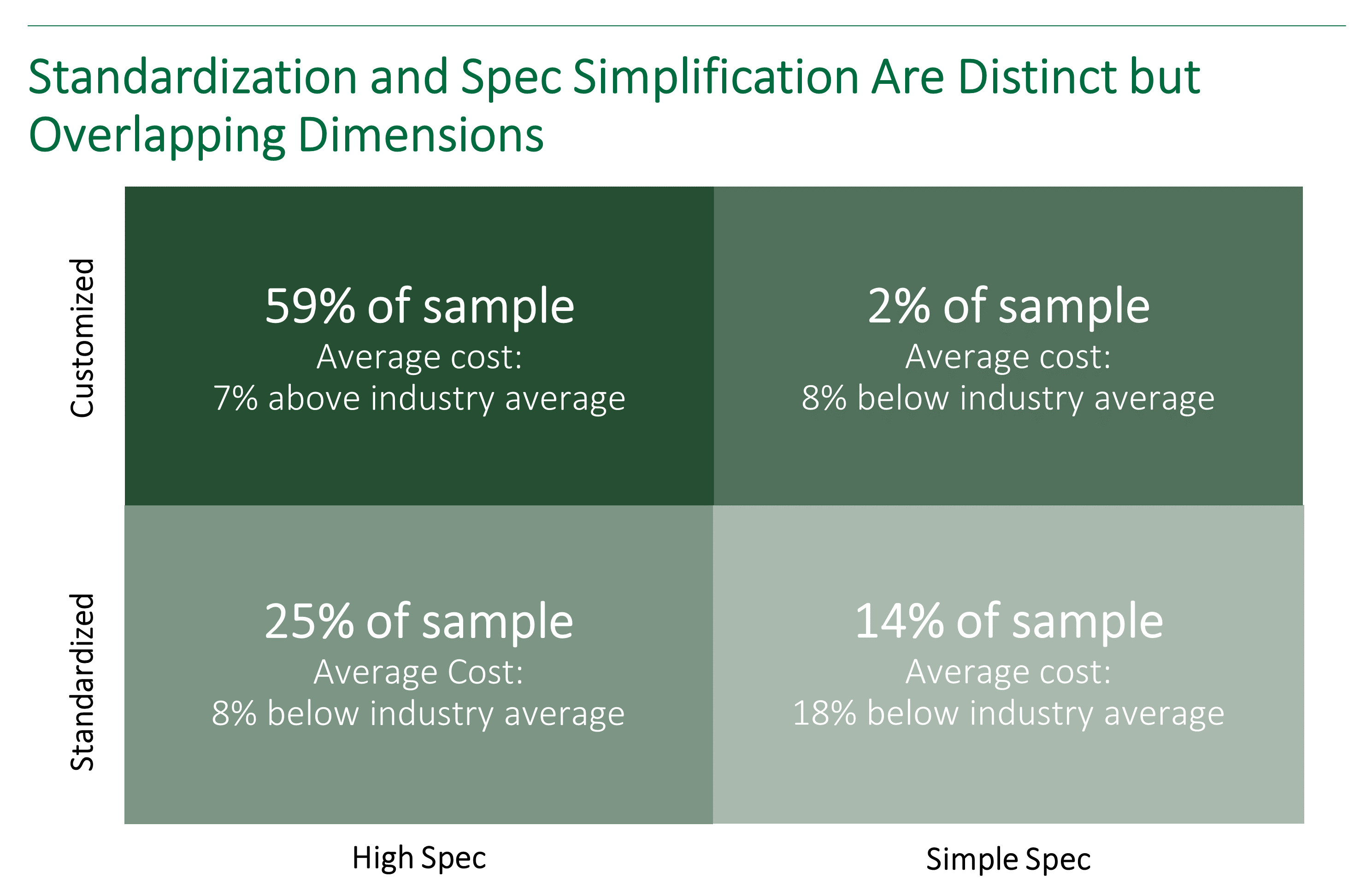

Simplification of technical specifications is another area of opportunity. The magnitude of this effect will become clearer in the next few years as more projects come online, but with the available data we see that an average 10 percent gain could be expected. This finding is significant and it is the first time our data have allowed differentiation of the effect of standardization from simplified specs. The two practices are distinct, with independent positive impacts on the projects, but have overlapping dimensions. We observe cases of standardized kit that is not simplified and vice versa, along with cases of both standardized and simplified specs. The biggest cost savings may yield a delta of about 25 percent between a ‘standardized + simple spec’ facility and one that follows a traditional customized approach with high spec requirements.[3]

Simplification of specs should not be considered a one-time initiative. The longer-term goal of wider owner acceptance of a common set of specifications is key to enabling the conditions where vendors can invest in developing cost saving standardized technology.

The view shared by participants in the study was that, in the long run, real savings will come from vendor led cost saving innovations. This is an interesting view coming from owner representatives: historically, owner companies in the oil and gas industry have been known to be quite protective of the provenance of their technical know-how because of the perceived competitive advantage it may provide. This has led to behaviors that preclude third-party innovation efforts, facilities over-design and, therefore, costly assets. Standardized vendor-led solutions are critical to low margin industries. The absence of these in oil and gas, with the exception of a couple of operators, hurts competitiveness and needs to be remedied if the offshore industry is to succeed as a low margin business. Our work with the commodity chemicals sector further bears this out—the advantaged companies are those that can continue to improve their margins by lowering their cost of projects. It also requires reducing the complexity of their projects. Chemical firms that could not simplify their projects and continued to focus on complex custom specs and designs are no longer around.

Together with efforts to establish a supply chain based on standard and simplified designs, there has been an industry push, more prominently in subsea, to deepen supplier relationships—that is, to focus on fewer suppliers but with an emphasis on deepening collaboration with that core group. This trend was aided by market consolidation, but it also seems to recognize the success that many have experienced by leveraging long-standing collaborative relationships both in subsea and production platforms.

In much of the project data we gathered, getting vendor input early, before scope decisions are landed, has led to deeper supplier relationships through the repeat use of the contractor and the supply chain, which is widely viewed as a positive. Because of the simultaneous use of these practices, the independent effects cannot be isolated at this time. We, therefore, attribute savings associated with maintaining deep supplier relationships through repeat use of the supply chain as a combined benefit with early contractor engagement. Note: some owners raised several downsides associated with this approach, one of which is that early commitment to a vendor puts negotiating leverage at risk and may hurt competitiveness, but we have seen this countered in several ways.

System Organization and Leadership as Key Enablers (or Barriers) of SCM-Related Practices

Although many organizations had partially standardized their subsea kits prior to 2014, the practice was not uniformly embraced. In part, this happened because of organizational barriers. Many past standardization initiatives failed in the face of resistance from technical leads; after all, engineers are in the business of engineering solutions. Simplification of specs is challenged in a similar manner. For years, the E&P industry took a laissez-faire approach to design robustness. Technical teams focused narrowly on ensuring high quality and integrity of the engineered assets, which admittedly is aligned with their mission. However, unless you are an engineering firm, facilities design and construction is a means to an end, not the objective. In this context, the businesses, who hold the capital purse need to test and challenge whether the quality of the design being delivered by their technical teams (aided by the engineering contractors) is excessive for the actual needs of the business case. Not doing so may lead to designs that are too heavy or robust for their purpose. Systematic overdesign results in gold-plated installations that are not only expensive to build but also expensive to maintain. The erosion of capital value becomes huge and permanent.

Another common barrier is organizational structure. Where project teams have greater autonomy and authority, standardization is disadvantaged because individual developments can more readily demonstrate how technical customizations yield optimal solutions. The benefits of standardization accrue more to the system than the individual development, but, in the absence of a strong centralized group making this case and enforcing discipline, it is easier for project teams to deviate. Keeping centralized functional groups, such as procurement, is also seen as an enabler while affording relatively strong and integrated project teams. The centralized procurement function is positioned to assess opportunities across the portfolio (e.g., to bundle and negotiate scope across projects) while assigning resources to project teams. In addition to procurement, a systemic approach to standardization, rather than customization, requires alignment and commitment of other key functions of asset development like reservoir, drilling, and commercial.

The other key enabling condition is leadership. The organizations that have responded most quickly and effectively to the market downturn benefited from clear top-down leadership on how the organization and its approach to projects would change. These organizations have made rapid progress in evaluating new initiatives, reaching conclusions on which strategies the organization would adopt, and pushing those strategies across the organization. This kind of transformational change requires a structured change management approach mandated from the top and organized with organization-wide participation of all key functions. IPA’s SPM research has been an instrumental component of the “needs assessment process” that identifies opportunities to reap the benefits of effective supply chain management.

Conclusions

Global oil and gas industry operators are being confronted with a stark scenario of diminished market prices and strong societal forces in favor of non-fossil derived fuels. Companies are being forced to reinvent their business model in what may turn them, if successful, into fully integrated energy companies. In this new model, fossil fuel assets will become increasingly less important, but their prominence as a primary source of energy will not fade away too abruptly. For several years to come, oil and gas operators will continue to pursue market opportunities for their fossil fuel assets albeit in much more stressed circumstances.

In their quest for improved capital gains, four major oil and gas operators have been exploring a diversity of project supply chain-related practices showing that standardization, repeat use of the supply chain, and simplification of technical specifications are important areas to understand and exploit. These approaches were aided by early engagement of key suppliers and contractors, an essential element for these practices to work. IPA has quantified the capital gains and they are staggering: they may range between 15 to 40 percent of third-party spend depending on how many of the identified practices are used on a particular project. For the practices to become embedded in an organization and provide sustaining benefits, a corporate change management approach is required. The challenge is not trivial because long-standing organizational and cultural barriers within the companies’ structures need to be broken and redefined.

Contact us for more information on IPA’s research and Capital Solutions opportunities in Supply Chain Management.

[1] Third-party spend includes all non-owner CAPEX cost categories, e.g., detailed engineering, fabrication, installation, etc.

[2] Edward W. Merrow and Jason Walker, The Efficacy of Unusual Contracting Approaches, UIBC 2018, IPA, November 2018.

[3] This analysis combines both FPUs and subsea systems; however, our data on where simplified specs have been employed is predominantly in subsea systems.